Delving into the realm of finding affordable general liability insurance for contractors, this guide unveils key insights and strategies to help navigate the complex landscape of insurance costs.

Exploring factors influencing insurance premiums, cost-saving strategies, and ways to identify reputable providers, this guide equips contractors with the knowledge to make informed decisions.

Factors to Consider When Looking for Cheap General Liability Insurance

When searching for affordable general liability insurance as a contractor, there are several key factors that can influence the cost of your coverage. Understanding these factors can help you make informed decisions and find the best insurance policy for your business.

Type of Business

The nature of your contracting business plays a significant role in determining the cost of general liability insurance. High-risk industries, such as construction or roofing, may have higher premiums due to the increased likelihood of accidents or property damage. On the other hand, businesses with lower risk factors, like consulting or IT services, may qualify for lower insurance rates.

Coverage Limits

The coverage limits you choose for your general liability insurance policy will directly impact the cost of your premiums. Higher coverage limits provide greater protection but come with higher costs. It's essential to assess your business's specific needs and risks to determine the appropriate coverage limits that balance protection and affordability.

Deductible Levels

Another factor that affects the cost of general liability insurance is the deductible level you select. A higher deductible typically results in lower premiums since you are agreeing to pay more out of pocket in the event of a claim.

Conversely, a lower deductible means higher premiums but less financial burden when filing a claim. Consider your budget and risk tolerance when choosing a deductible level.

Assessing Risks and Claims History

Insurance companies take into account your business's risk profile and claims history when calculating insurance costs. A history of frequent claims or high-risk activities can lead to higher premiums. By proactively managing risks, implementing safety measures, and maintaining a clean claims record, you can potentially lower your insurance costs over time.

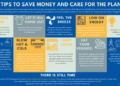

Strategies for Lowering General Liability Insurance Costs

When it comes to lowering general liability insurance costs for contractors, there are several strategies that can be implemented to help reduce premiums and overall expenses.

Bundling Insurance Policies

- Contractors can often receive discounts on their general liability insurance by bundling it with other insurance policies, such as property insurance or commercial auto insurance.

- Insurance companies typically offer lower rates for bundled policies, making it a cost-effective option for contractors looking to save money.

Improving Workplace Safety Measures

- One effective way to reduce insurance premiums is by implementing and improving workplace safety measures.

- By creating a safe work environment, contractors can minimize the likelihood of accidents and insurance claims, ultimately leading to lower insurance costs.

- Insurance companies often reward businesses with strong safety records by offering lower premiums as a reflection of reduced risk.

Increasing the Deductible Amount

- Another strategy to consider is increasing the deductible amount on a general liability insurance policy.

- By opting for a higher deductible, contractors can lower their monthly insurance payments, although they will be responsible for paying more out of pocket in the event of a claim.

- This approach can be beneficial for contractors with a strong financial cushion who are comfortable taking on more risk to save on insurance costs.

Researching Affordable Insurance Providers

When looking for affordable general liability insurance, it is crucial for contractors to research and compare different insurance providers to find the best rates that suit their budget and coverage needs.

List of Reputable Affordable Insurance Providers

- ABC Insurance Company

- XYZ Insurance Agency

- 123 Insurance Group

It is recommended to request quotes from multiple providers to compare rates and coverage options.

Importance of Comparing Quotes

By comparing quotes from various insurance providers, contractors can ensure they are getting the best value for their money. Different insurers may offer different rates and coverage options, so it is essential to shop around.

Reading Reviews and Checking Ratings

Before selecting an insurance provider, contractors should read reviews and check ratings to ensure the company is reliable and has a good reputation. This can help contractors make an informed decision and choose a provider that meets their needs.

Utilizing Industry Associations and Groups for Discounts

Contractors can benefit greatly from leveraging industry associations or trade groups to access discounted insurance rates. These organizations often have partnerships with insurance providers that offer special discounts to their members. By joining these professional groups, contractors can take advantage of group insurance plans that are typically more affordable compared to individual policies.

Benefits of Joining Professional Organizations

- Access to discounted insurance rates: Professional organizations negotiate group insurance plans with providers, resulting in lower premiums for members.

- Networking opportunities: Being part of industry associations allows contractors to connect with peers and share information on cost-saving insurance options.

- Resources and support: Professional groups often provide valuable resources, guidance, and support related to insurance matters.

Networking for Cost-Saving Opportunities

- Attend industry events: Networking at conferences, seminars, and workshops organized by professional associations can lead to discovering affordable insurance options.

- Collaborate with peers: Building relationships with other contractors within the same industry can result in recommendations for insurance providers that offer competitive rates.

- Stay informed: By staying active in industry associations, contractors can stay informed about new insurance trends, discounts, and cost-saving opportunities.

Concluding Remarks

In conclusion, the quest for cheap general liability insurance doesn't have to be daunting. By leveraging the information and tips provided in this guide, contractors can secure the coverage they need at a price that fits their budget.

Question & Answer Hub

What factors influence the cost of general liability insurance?

The type of business, coverage limits, and deductible levels can all impact insurance premiums.

How can contractors lower general liability insurance costs?

Contractors can bundle insurance policies, improve workplace safety measures, and increase deductible amounts to reduce premiums.

Why is it important to research affordable insurance providers?

Researching allows contractors to compare quotes, read reviews, and check ratings to find the best rates and choose a reliable provider.

How can contractors access discounted insurance rates through industry associations?

Contractors can leverage industry associations or trade groups, join professional organizations with group insurance plans, and network within industry groups to find cost-saving opportunities.