Best Low-Cost Insurance Options for Small Businesses Worldwide sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

As we delve deeper into the realm of low-cost insurance options for small businesses globally, a wealth of information awaits to help businesses navigate the complex landscape of insurance decisions.

Factors to Consider When Choosing Low-Cost Insurance

When looking for low-cost insurance options for your small business, it is essential to consider several factors to ensure you get the best coverage at an affordable price.Discuss the importance of comparing coverage options, deductibles, and premiums.

Identify Specific Insurance Needs

- Assess the size and nature of your small business to determine the specific insurance needs.

- Consider factors such as the number of employees, the type of industry, and the risks involved.

Comparing Coverage Options

- Compare the coverage options offered by different insurance providers to find the best fit for your business.

- Look for policies that cover essential areas such as liability, property damage, and employee benefits.

Evaluating Financial Stability and Reputation

- Research the financial stability of insurance providers to ensure they can fulfill their obligations in case of a claim.

- Check customer reviews and ratings to gauge the reputation of insurance companies in the market.

Types of Low-Cost Insurance Available for Small Businesses

When it comes to protecting your small business, having the right insurance coverage is crucial. Here are some common types of low-cost insurance options that small businesses can consider:

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims against your business. It helps protect your business from legal costs and settlements resulting from covered claims.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, covers claims of negligence related to professional services or advice provided by your business. It can help cover legal fees, settlements, and judgments if a client alleges that your services caused them financial harm.

Property Insurance

Property insurance protects your business property, including buildings, equipment, inventory, and furniture, from risks such as fire, theft, vandalism, and natural disasters. It can help cover the cost of repairing or replacing damaged property.Business Location and Industry Influence Insurance Coverage:The location of your business and the industry you operate in can impact the type and cost of insurance coverage you need.

For example, a business located in a high-crime area may require higher property insurance premiums. Similarly, industries with higher risks, such as construction or healthcare, may need specialized insurance coverage.Benefits of Bundling Multiple Insurance Policies:Bundling multiple insurance policies, such as general liability, professional liability, and property insurance, can often result in cost savings for small businesses.

Insurance companies may offer discounts or package deals when you purchase multiple policies from them. Bundling can also simplify the insurance process by having all your coverage under one provider.

Global Comparison of Low-Cost Insurance Options

When comparing low-cost insurance options for small businesses worldwide, it is essential to consider the variations in coverage, regulations, and pricing structures based on different countries or regions. Local laws and market conditions play a significant role in determining the affordability and availability of insurance options for small businesses.

United States

In the United States, small businesses have access to a variety of low-cost insurance options such as general liability, property, and workers' compensation insurance. The pricing structures may vary based on the size of the business, industry, and location. Regulations set by individual states can impact the coverage requirements and costs for small businesses.

United Kingdom

In the United Kingdom, small businesses can opt for public liability insurance, professional indemnity insurance, and employer's liability insurance at affordable rates

Australia

Australian small businesses can choose from insurance options like business interruption insurance, cyber insurance, and product liability insurance. The insurance sector is regulated by the Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC). Factors such as the business's risk profile and claims history can affect the cost of insurance coverage.

Canada

In Canada, small businesses can explore insurance options such as commercial property insurance, commercial auto insurance, and professional liability insurance. Each province has its own regulatory body overseeing insurance practices, which can impact the pricing and coverage of insurance policies.

Market competition and regional risks play a role in determining insurance affordability.

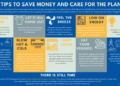

Strategies to Lower Small Business Insurance Costs

When it comes to managing the expenses of your small business, finding ways to lower insurance costs can make a significant impact on your bottom line. By implementing smart strategies and proactive risk management practices, you can reduce insurance premiums without sacrificing the coverage your business needs.

Regularly Review and Update Your Policies

One effective way to lower small business insurance costs is to regularly review and update your policies. As your business evolves, your insurance needs may change. By reassessing your coverage and making adjustments as needed, you can ensure that you are only paying for the protection you actually require.

Implement Risk Management Practices

- Identify and assess potential risks: Conduct a thorough risk assessment to identify areas of vulnerability within your business.

- Implement safety measures: Take steps to mitigate risks by implementing safety protocols and procedures.

- Training and education: Provide training to employees on safety practices to reduce the likelihood of accidents or incidents.

- Regular maintenance: Keep equipment and property well-maintained to prevent costly damages.

Shop Around for Competitive Rates

Don't settle for the first insurance quote you receive. Shop around and compare rates from multiple insurers to find the most competitive pricing for your coverage needs. Different insurance companies may offer varying rates, so it's important to explore your options to secure the best deal.

Consider Bundling Policies

Many insurers offer discounts for bundling multiple policies together. By combining your small business insurance needs, such as general liability and property insurance, with the same provider, you may be able to secure a lower overall premium.

Final Thoughts

In conclusion, the exploration of the best low-cost insurance options for small businesses worldwide unveils a tapestry of choices and considerations for businesses to ponder. This discussion serves as a guiding light in the intricate world of insurance, fostering informed decision-making and financial security for small enterprises across the globe.

Query Resolution

What factors should small businesses consider when choosing low-cost insurance?

Small businesses should identify their specific insurance needs, compare coverage options, and evaluate the financial stability of insurance providers.

What types of low-cost insurance are commonly available for small businesses?

Common types include general liability, professional liability, and property insurance. Businesses can also benefit from bundling multiple policies for cost savings.

How can small businesses lower their insurance costs effectively?

Small businesses can reduce premiums by implementing risk management practices, reviewing policies periodically, and seeking ways to maintain coverage while minimizing costs.